9 Ways to Save for Travel (and Still Enjoy Life at Home)

We’ve funded months of international travel just by making small changes at home — and you can too. These aren’t “stop living your life” tips — they’re practical swaps and smarter money habits that free up cash for the things that matter most: eating, drinking, and exploring the world.

Let’s dive into the exact strategies we’ve used (with real numbers) to turn our travel dreams into booked tickets.

1. Know Your Numbers Before You Start Saving

Before you can cut expenses, you need to know what’s coming in and what’s going out. You can do this by creating a simple excel spreadsheet and going through your monthly bank statements or most banking apps will show you what you’re spending your money on.

Add up your monthly income.

Subtract your expenses (rent, utilities, insurance, minimum debt payments).

Whatever’s left is your travel potential — but only if you’re intentional about where it goes.

Budgeting apps: Budget App, Rocket Money, Every Dollar. DISCLAIMER- We use the old fashioned way to budget while at home- google spreadsheet. We’ve created a FREE (and very simple) budget sheet to see where your money is going. You can download it for free and see what your true travel potential is!

💡 How to Use This Budget Sheet

Click the link below to open the sheet. It’s set to View Only so the original stays intact.

To get your own editable version:

Go to File → Make a copy

Save it to your own Google Drive

Start entering your numbers!

👉 Click here to open the Budget Sheet

2. Stop Eating Out

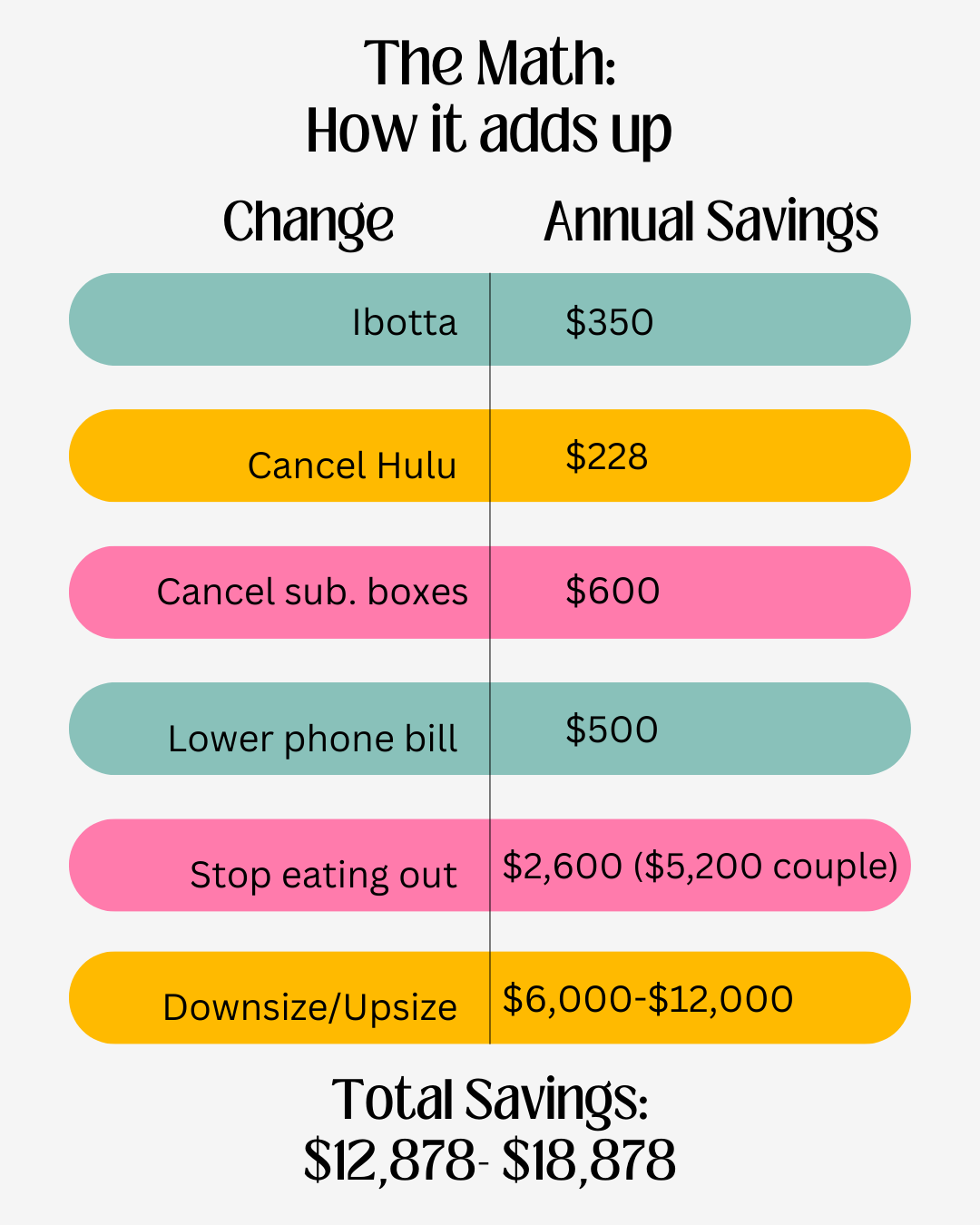

Eating out can quickly become a significant expense. A dinner with a drink, appetizer, and entrée can hit $50+ per person. Once a week for a year? That’s $2,600 per person or $5,200 per couple. Even a daily Starbucks habit adds up to $364 annually. When we committed to cooking at home and bringing lunch to work, Lemon and I saved over $1,000 in just six weeks. We still enjoy a night out here and there — but now it’s intentional, not habit.

Meal planning and prepping are essential to saving money. Always be prepared so you aren’t tempted to go out to eat, grab takeout, or — worse — order delivery. In fact, delete the food delivery apps off your phone right now!

We set a weekly grocery budget of $100 for regular groceries and $150 a month for Costco (including dry goods, food, alcohol etc.). This way, we don’t overbuy. We use Pinterest to search for healthy, budget-friendly meals and keep a rotation of about 10–15 that we cycle through. Buying meat and other staples in bulk also saves a ton.

Not eating out can get boring, so we make it fun: theme nights with dishes from around the world, and Sunday brunches complete with music, candles, and cooking together.

Learning to cook in Thailand not only gave us incredible new recipes, it reminded us how fun it can be to make meals at home. Cooking together keeps us from defaulting to restaurants — and every dollar we save here goes straight into our next adventure fund!

3. Pay Off Your Debt

Starting long-term travel (or any travel) with debt is like hiking with a backpack full of bricks.

Pay off credit cards in full each month to avoid interest.

If your interest rate is high, consider a personal loan with a lower rate to consolidate.

I once switched from a credit card at 22% interest to a personal loan at 7% — instantly saving hundreds in interest. Lending Club made this process super simple. If you are interested, check them out https://refer.lendingclub.com/Evan9

4. Skip Happy Hour (or Host It at Home)

We get it — skipping happy hour hurts. But even two drinks and a snack once a week can quietly drain hundreds each year.

Instead, invite friends over for a home happy hour. Everyone brings something, and you still get the laughs without the $60 bar tab. PRO TIP- Buy your alcohol at Costco to save $$. Large vodka is only $13, Prosecco under $10- you literally can’t beat those prices!

5. Use Money-Saving Apps

If you’re not using apps to save, you’re leaving money on the table. Use apps like Ibotta to help save on groceries. We have saved over $300 in a year using this app! Personally, I’m not the best with couponing apps. But Lemon is a couponing king! If you sign up you can use Lemons referral code 6tdzew at registration. You can also save money when shopping online by installing apps like Capital One Shopping and Rakuten. Here’s what we use:

Ibotta – Cash back on groceries. We’ve saved over $300. Sign up here

Capital One Shopping – Automatically searches for better prices and coupon codes when you shop online. It’s free, works even if you’re not a Capital One cardholder, and has saved us hundreds on travel gear and everyday purchases. Try it here

Rakuten – Cash back for online shopping. Join here

Your Banking App – Schedule bi-weekly transfers from checking into savings

Upside – Earn cash back on gas, groceries, and restaurants just by snapping a photo of your receipt or checking in through the app. We’ve used it to earn money back on road trips and even everyday errands. Sign up here

6. Cut Streaming Services

Pick one streaming service — max. Subscribing to three or four is $30–$50/month you could put toward flights.

We kept Netflix because it works internationally and lets us watch shows not available back home.

💡 Affiliate add-on: Recommend a VPN for travelers who want to access their home streaming libraries abroad. Link your VPN of choice.

7. Cancel Subscription Boxes

That $50 monthly box? That’s $600 a year. They’re fun for a bit, but will you remember them five years from now — or the trip they could have paid for?

Choose the trip.

8. Lower Your Bills

Most people may not even be aware that you can lower your fixed expenses. Call your internet, phone, and insurance providers — ask if they can match competitor rates or negotiate a lower price. Many will, just to keep you. We cut our phone bill by switching to Mint Mobile — same coverage, way less money. We pay about $15/month each, which saves us over $500 a year compared to our old plan. And when you prepay for the year you get a discount!

Companies to contact:

Cell phone provider (or switch to Mint Mobile)

Internet provider

Car insurance

Electric company- see if they have an energy savings plan.

9. Downsize or Upsize Your Living Situation

For two years we lived in a 4-bedroom house with roommates, paying $450 each. If we’d been in an apartment, it would’ve been $700+ each. Savings over two years? $6,000. We’ve also lived with my mom for $500/month. Not glamorous, but the savings go straight into our travel fund.

Ideas:

Rent out a spare room on Airbnb

Move in with roommates

Sell or rent out your house

Move back in with family short-term

In the quest to save for your travel adventures, remember that every dollar counts. These practical steps, from cutting out unnecessary expenses to managing your debts and seeking out money-saving apps, can have a substantial impact on your travel fund. While it might be tough to skip out on some social events or cancel those tempting subscription boxes, the freedom and experiences that await you on your journeys are well worth the sacrifices.

As you embark on this financial journey towards your travel dreams, keep in mind that it's not just about saving money; it's about investing in unforgettable experiences and memories that will last a lifetime. So, stay determined, stay frugal, and watch your travel savings grow!

A step by step guide to planning a trip abroad.